We’ve talked in earlier articles about the Socially Responsible Investment Guidelines of the United States Conference of Catholic Bishops (USCCB). In that 26-page document, the bishops enumerate a number of business activities that make a company unfit for investment.

The investment activities that the USCCB identify as unfit for investment include, but are not limited to abortion, euthanasia, human embryonic stem cell research, pornography and others. The list focuses on moral issues.

On the other hand, the ESG investing movement is driven by Environmental, Social and Governance (ESG) issues.

It’s important to understand the difference and to ask the right questions.

What qualifies as an ESG investment?

Interestingly, there is no uniform agreement on exactly what issues should be considered when making ESG investment choices. Nor is there any uniformity on how to score a company’s ESG activities. Lastly, there is limited, albeit increasing, corporate reporting  on ESG issues.

on ESG issues.

A Wall Street Journal article of November 2, 2022, reported on a study from the Massachusetts Institute of Technology (MIT) of six leading ESG rating providers.

The authors of the MIT study found that “ESG ratings vary substantially depending on which provider is doing the ratings – to a point where a company could be highly rated with one rating company and have a very low score with another….In other words, the six [ESG rating providers] never all agreed on a company’s ESG rating, and in most cases there was little agreement among them.”

On top of this confusion, a 2019 study by Robert Huebscher of Advisor Perspectives, indicated that over the previous 10 years, ESG funds had, as a group, woefully underperformed the S&P 500 Index.

And lastly, there is a raging debate over whether the ESG movement has been hijacked for progressive political purposes.

Buyer Beware

As of this article, 19 state attorney generals have launched an investigation into the ESG-related activities of half a dozen Wall Street firms.

This all leads me to believe that, even if you accept the questionable principles of ESG investing, it is a classic case of caveat emptor or “buyer beware”.

In short, without doing substantial research, you really don’t know what you’re getting when you buy an ESG fund.

What is the problem for a Catholic investor?

Over the years, I have had numerous conversations with potential clients regarding ESG investing.

Usually, the conversation revolves around a promise made by the investor’s current advisor that investments will only be made in “good” funds that correspond to the investor’s moral values.

The investor seldom knows what funds are owned in their account. An inspection of the funds actually owned normally reveals several ESG funds.

Why is that a problem for a Catholic investor? Presuming that the investor wishes to invest morally, the simple answer is that ESG issues are not synonymous with USCCB issues. A favorable ESG rating is not a guarantee that a company will be operating in accordance with Catholic teaching.

A recent example

I was recently contacted by a member of an Archdiocesan cemetery investment board about conflicts between ESG ratings and Catholic acceptability.

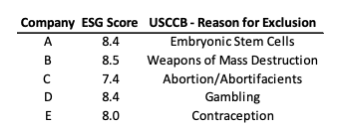

Specifically, he was looking for companies with favorable ESG scores that would be excluded under the USCCB investment guidelines. I sent him this table of examples:

The ESG score is on a scale of one (unfavorable) to ten (favorable) and is from one of the leading providers.

Please note that (1) this was at a particular point in time and that (2) a company’s ESG score as well as its suitability under the USCCB investment guidelines can change. Therefore, the actual names of the companies have been removed. These five companies (A,B,C,D and E in the chart above) were only a representative sample of many possible companies where such scoring conflicts existed.

The bottom line

I often review the existing portfolios of potential clients so that they can see where problems may exist in the funds they own.

I have yet to find an ESG fund that is free of investments in morally problematic companies.

The bottom line for a concerned Catholic investor: ESG investing is not a viable substitute for investing based on the bishops’ guidelines.

You must be logged in to post a comment.