The London Interbank Offered Rate (Libor) — once called the world’s most important number — is an interest-rate benchmark that has influenced borrowing costs for consumers, businesses, and investors around the world since 1986.1–2 It’s been quoted in five currencies (British pound, Swiss franc, Euro, Japanese yen, and U.S. dollar) from the daily submissions of bankers who estimate the rate they would charge to lend each other money.

Because Libor is based on quotes instead of actual transactions, it’s possible for participating banks to skew interest rates in their favor. A 2012 scandal exposed widespread market manipulation, and it’s believed that Libor played a role in worsening the 2008 financial crisis. As central banks slashed benchmark interest rates to help reduce borrowing costs and support the global economy, Libor rose instead.3

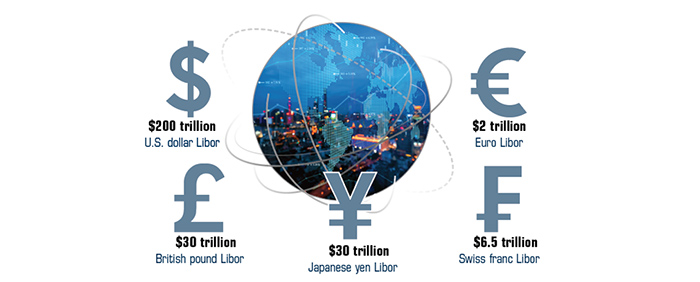

To help strengthen the global financial system, industry regulators are working to replace Libor with more reliable benchmarks — but it’s a monumental task. U.S. dollar Libor still determines the interest rates on more than $200 trillion in financial products, including private student loans, credit cards, adjustable-rate mortgages, business loans, and a wide array of securities and insurance contracts.4

Deadline Looms

The administrator of Libor stopped polling banks and publishing some Libor settings at the end of 2021, but others will be available through June 2023 so that most legacy contracts can mature before Libor is fully retired. As a result, U.S. regulators told financial institutions not to issue new financial contracts based on Libor after December 31, 2021, though they may continue to reference it for many existing debts until June 30, 2023.5

The Alternative Reference Rates Committee (ARRC) is a working group of private market participants such as banks, insurers, and asset managers convened by the Federal Reserve Board and the Federal Reserve Bank of New York in cooperation with other federal regulators. The ARRC began identifying and addressing transition issues and analyzing potential alternative rates in 2014 and officially endorsed the Secured Overnight Financing Rate (SOFR) as the new preferred benchmark rate in 2017. Since then, the ARRC has been facilitating an orderly transition by encouraging adoption of SOFR, recommending best practices, developing the SOFR markets, drafting fallback language and proposing legislation that helps reduce legal uncertainty for outstanding legacy contracts, and publishing industry progress reports.

Subject to Change

Face value of financial products benchmarked to Libor, by currency

Source: IBOR Global Benchmark Survey 2018 Transition Roadmap, ISDA

New Benchmarks

Many financial instruments previously tied to U.S. dollar Libor will be linked instead to SOFR. Per the ARRC, SOFR is a “nearly risk-free” reference rate that is fully based on transaction data from the U.S. Treasury repurchase agreement (repo) market. SOFR was recommended because it is suitable for use in most financial products and has much larger underlying transaction volumes than other Libor alternatives.6

Other central banks have recommended their own benchmarks to replace Libor, such as the reformed Sterling Overnight Index Average (SONIA) in the United Kingdom.

For some products, financial institutions might decide to reference alternative rates that are “credit sensitive,” as they may better reflect lenders’ funding costs. However, regulators have warned that switching to benchmarks other than SOFR may present similar risks to financial market stability as Libor.7

Moving away from Libor is a complicated and costly endeavor for the many financial institutions that must analyze their exposure, adjust risk and valuation models to account for replacement rates, update contracts, communicate with clients, meet reporting requirements, and so forth. It’s estimated that transition costs will exceed $100 million for each of the major banks in 2021 alone.8

Consumers and businesses with existing adjustable-rate loans based on Libor should pay attention to their lenders’ communications regarding changes to reference rates. A switch to a different index could result in a higher base rate and larger borrowing costs in the future.

——————————–

Thomas Payne is a seasoned registered financial advisor who is passionate about Catholic values investing. He is the founding principal at Prosperitas Wealth Management. Learn more here.

——————————-

U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of all bonds fluctuates with market conditions. Bonds not held to maturity could be worth more or less than the original amount paid. The FDIC insures CDs and bank savings accounts, which generally provide a fixed rate of return, up to $250,000 per depositor, per insured institution. Forecasts are based on current conditions, subject to change, and may not come to pass.

You must be logged in to post a comment.