Earlier this year, just like every year, the Church celebrated the feast day of St. Thomas the Apostle. Thomas, of course, is especially famous because he refused to believe in Christ’s resurrection until he, personally, saw the risen Lord (and put his fingers into the wounds He had suffered in the crucifixion). Once his requirements had been met, Thomas exclaimed “My Lord and my God!”, thereby acknowledging Jesus’ resurrection from the dead.

Disbelief and Questions regarding Catholic Investment principles

We often encounter people interested in our investment work who are skeptical of the returns we have achieved. The reasoning runs something like this: “If you’re excluding some stocks from your investments regardless of their financial merits, then there is some probability that you will be passing up stocks that perform better than the ones that you’re including and that’s just too big a risk for me to take.”

Let’s break that down and examine it more closely.

How it works

Excluding stocks is one aspect of what we do, no doubt about it. Right now, we have a list of about 250 companies that we won’t touch because they violate the Investment Guidelines laid out by the U.S. Conference of Catholic Bishops. It’s entirely possible that some of them will be great performers.

But let’s put those excluded companies into context.

First off is the moral dimension. Companies on this list are involved in activities that, at best, are morally questionable and at worst detestable. That aside, we limit ourselves to stocks that trade on one of the three major exchanges (NYSE, New York, and American) and are priced at $5 per share or above.

Those two restrictions, put in place for trading and quality control reasons, reduce the pool of potential stocks by about 850, a far greater number than those excluded for moral reasons. These sorts of restrictions are very common among institutional investors. In fact, based on my experience having worked at an institutional investment operation, I think that most of the large firms are even more restrictive than we are based on their need for liquidity alone.

A deeper dive

Taking a deeper dive, there are about 5,110 stocks listed on the 3 major exchanges. Adding the restriction that the stock price must be at least $5 drops the number of companies that could be considered to 3,595 according to YCharts. Relative to that number, the 250 or so companies that we exclude for moral reasons amount to just 6.9% of the possibilities. Put another way, imposing the restrictions of the USCCB, we are still able to invest in over 93% of the total universe under consideration.

The bottom line, of course, is whether the modestly limited investment choices impact results.

While we don’t have the same depth of experience as the USCCB, we do have more than 20 years of real world investment experience following the USCCB guidelines. We have not seen any evidence that our investment results have been negatively impacted by the restrictions imposed. The best examples of this are our index based strategies. In these strategies, we try simply to mirror the selected index but with the morally objectionable companies omitted. No subjective input, just simple exclusion.

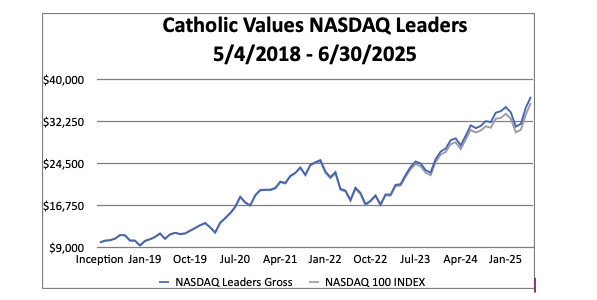

Example 1: Our NASDAQ Leaders strategy

Example one of this approach is our NASDAQ Leaders strategy which is our version of the NASDAQ 100 Index. The NASDAQ 100 Index is comprised of the largest market capitalization companies listed on the NASDAQ stock exchange. We clean it of companies that don’t pass the moral filters of the USCCB guidelines.

Depicted below is the performance of that portfolio compared to the performance of the NASDAQ 100 Index before the deduction of any management fees. (Management fees at 1% annually reduce the full period annualized performance to 18.78% from the 19.95% shown while the Index returned 19.43%. The graph represents actual results and is not hypothetical).

The chart, I think, speaks for itself. Omitting the companies that transgress the USCCB guidelines has not had a detrimental impact on performance. It has been our experience that this is the rule rather than the exception.

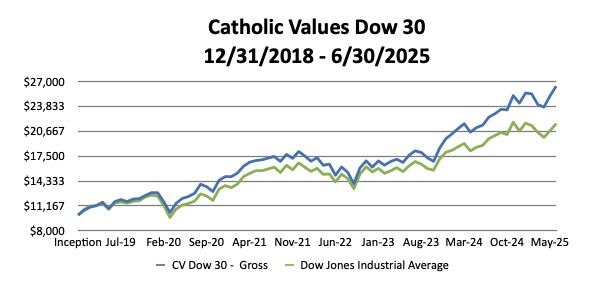

Example 2: Catholic Values Dow 30

Let’s include one more example. We have a portfolio that’s designed to provide an alternative to the Dow Jones Industrial Average. Here again, we start with the Index and simply remove those stocks that violate the bishops’ guidelines. By good fortune or providence, the results have been stellar, as you can see below.

(The portfolio performance net of management fees is lower at 15.14% versus 16.28% before fees and as shown above. The Dow itself posted an annualized 12.74% return over the period. Again, the graph depicts actual results.)

Now for some important disclaimers. First, the data above has been carefully collected and computed but errors may exist. Secondly, past performance does not guarantee future performance. Not all portfolios will necessarily provide positive returns or outperform their respective benchmarks.

To quote the USCCB: “Investment strategies are to be based on Catholic moral principles as outlined in the teachings of the Holy See and the statements of the USCCB. Companies, securities, or investment funds that produce a significant amount of revenue from immoral activities should not be invested in.” Using that statement as a measuring stick, the vast majority of available investment funds should be avoided.

Given the evidence presented above, worries about performance don’t appear to be a valid objection to pursuing the moral high ground. Now that you’ve seen, like St. Thomas, it’s time to believe.

You must be logged in to post a comment.